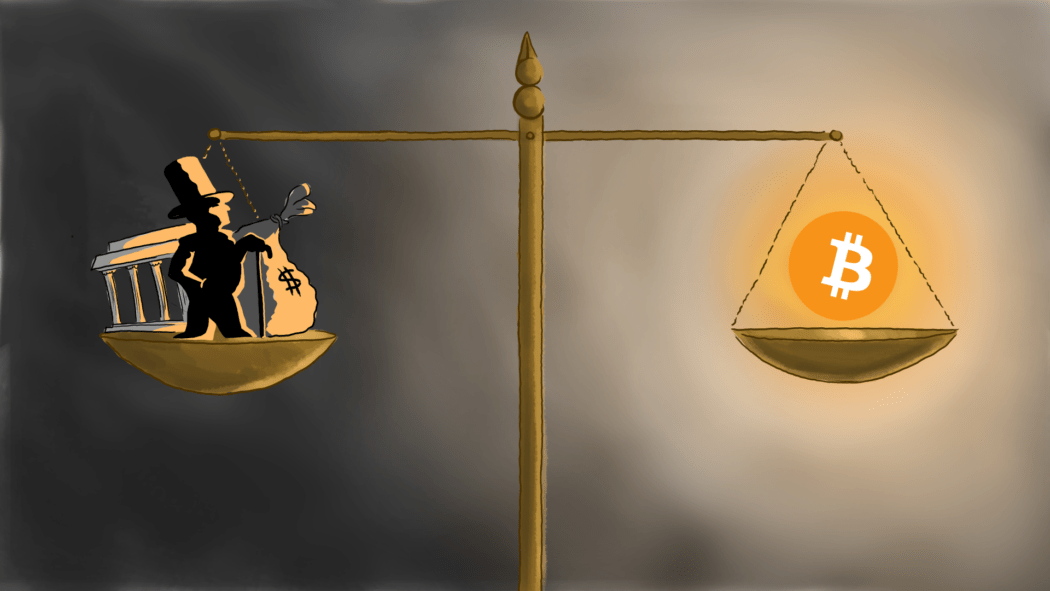

Opinion: Bitcoin is increasing economic equality

Historically, governments and banks have total control over minting currencies, transferring money and creating economic policies. But a novel technology is disrupting these monopolies and creating a more equitable financial system for all.

Bitcoin was launched in 2009. It was the world’s first cryptocurrency and is somewhat similar to the dollar or Euro. Unlike traditional currencies, however, the Bitcoin network is decentralized and not beholden to any central bank or government. It is run by millions of different computers across the world. As a result, Bitcoin can’t be manipulated and is censorship resistant. Transactions are nearly instant, involve no intermediaries and incur minimal fees.

Bitcoin has changed dramatically since 2009, but today it is having a profound positive impact on underserved and disadvantaged populations.

International money transfers are a prime example. Each year migrant workers and immigrants send billions of dollars back to their families in their country of origin.

Historically, these people have been forced to use monopolistic companies like Western Union and MoneyGram that charge absurd fees. Additionally, transfers take days to complete and must be picked up at a bank, which leaves recipients vulnerable to violence and robbery in unstable countries.

Bitcoin fixes this problem. Anyone with an internet connection can send money across borders for a fraction of the cost and from the comfort of their own homes.

El Salvador took note of the powerful technology behind Bitcoin and adopted Bitcoin as legal tender in June of this year. Since then, more than three million El Salvadorans, or nearly half of the total population, have set up a Bitcoin wallet. In contrast, less than a third of the population have bank accounts.

With no documentation required, Bitcoin is helping connect people who would normally be excluded from financial systems. Many Bitcoin exchanges don’t require identifying information, allowing stateless individuals to invest, save and increase their socioeconomic mobility.

Bitcoin is having a large impact in the United States as well. Year to date, the U.S. stock market has risen by around 20%. Over the same period Bitcoin has more than doubled, growing by nearly 130%.

Critics say Bitcoin experiences large price swings and is impractical for everyday transactions. Largely, I agree with them. There’s no point in paying for your coffee with Bitcoin when you could use dollars instead.

For the average person, Bitcoin is best used as a long-term investment. It has a fixed supply of 21 million, meaning no more Bitcoin will be produced by the year 2140. As such, a recent Bank of America report described Bitcoin as “digital gold,” and noted it can be used as a hedge against inflation.

In recent months, inflation has risen sharply following the coronavirus pandemic, large government spending packages and supply chain disruptions. As a result, individual investors and large institutions alike are turning to Bitcoin.

Bitcoin is especially promising for low- and middle-income individuals. During inflationary periods, the rich tend to get richer as the value of stocks and real estate go up. But people with fixed wages and few assets end up receiving the same paycheck while prices continue to rise.

Bitcoin offers an alternative. Rather than leaving cash in bank accounts or under the mattress where its value will only decrease, investing in Bitcoin can lead to greater long-term financial security. And as explained before, Bitcoin is accessible to everyone.

Tanner and Hannah Howell are both Utah State Aggies. Tanner is a senior studying biochemistry, and Hannah is a recent graduate. They described the impact cryptocurrencies have had on their financial security.

“I feel like as students and you know, especially as a recently married couple, we don’t have to worry about the basics anymore,” Hannah said. “You don’t have to worry about like ‘Oh, can I buy this item at the grocery store, you know, or am I going to have to spend it one rent?’ We don’t have to worry about the day-to-day things quite as much, and crypto has been a huge part of giving us that security.”

The future looks bright for cryptocurrencies. Bitcoin has spurred several other innovations, such as the invention of decentralized finance, or DeFi. DeFi allows anyone to lend or borrow money without requiring a bank or credit check, and makes complicated financial instruments available to anyone across the globe.

The great thing about Bitcoin and DeFi is that it is entirely run by computer code. It leaves no room for pesky human interference or bias.

A world run on Bitcoin and similar technologies would mean the end of predatory lending practices to primarily lower income minority families. It would mean the end of housing discrimination based on race, sex, orientation or identity

From Afghanistan to Venezuela and everywhere in between, cryptocurrencies are helping to create a more equitable global financial system.

Eddy Pfeiffer is a third-year psychology major. In his free time he loves to hike, camp, and lose money trading cryptocurrencies.

edward.pfeiffer@usu.edu